2021 - What a year, but what next?

Jan 6th, 2022As the curtain closes on 2021, and we enter 2022, it is an appropriate time to briefly summarise the investment climate of the last 12 months and consider what might lie ahead for investors over the course of the next year and beyond.

2021 began with a real sense of public optimism, in that the newly developed vaccinations against coronavirus might provide a route out of lockdown restrictions and a return to something at least resembling ‘normality’.

Vaccine rollout began strongly (in the developed world at least), with the elderly and most vulnerable quite rightly prioritised, followed by successive age groups. As at 29th November 2021, the ONS estimated that approximately 9 out of 10 people in the UK had coronavirus antibodies, whether acquired via vaccine or following a past Covid infection.

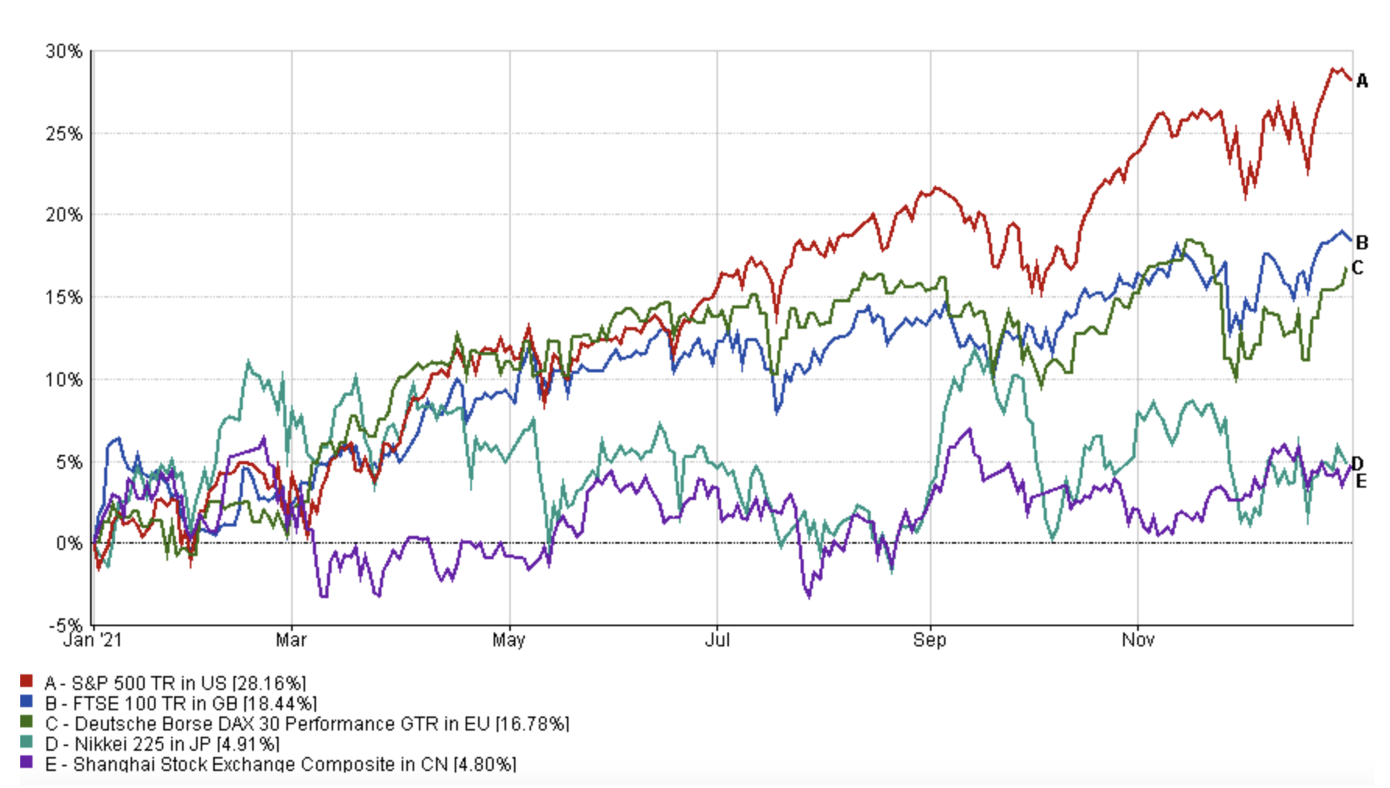

This optimism seemed to be reflected in global stock markets, with most indices posting positive returns, well into double figures in some instances.

The following chart illustrates how a selection of markets fared throughout 2021 (noting that returns are in respective local currencies):

US markets in particular continued to reach all-time highs - the S&P 500 hit 70 new closing highs in 2021 - this being despite widespread political, social and economic tensions. For example, on 7th January 2021, the day after a pro-Trump crowd stormed Capitol Hill, the S&P hit one of those record highs.

Markets also seemed to be bullish about business prospects in China despite its growing tension with the US, and the ever-increasing woes of Evergrande, the world’s most indebted company (with liabilities exceeding $300bn) and the failure of which could potentially have implications like those seen during the 2008 financial crisis.

Coronavirus, whether Delta or the much more recent and contagious Omicron variant, and a global death toll that exceeded 5,000,000 also failed to halt markets. Although there were some wobbles along the way, markets consistently bounced back to new highs once any initial concern or panic subsided.

Whether this can continue into 2022 is the question on every investor’s lips.

It is worth remembering that throughout much of the pandemic the stock market has been somewhat detached from the social and financial reality that we have lived through. Indeed, this is often the case; stock market movements will not necessarily correlate with the prevailing condition and health of the wider economy.

Much of the market’s performance over the last 18 months or so is owed to the colossal amount of financial stimulus, in various guises, that initially propped markets up, but then went on to fuel much of the growth subsequently enjoyed.

Moving into 2022, investors cannot rely on this support continuing, and there are a few headwinds that may take some of the wind out of investors’ sails.

The first sign that the end of the stock market’s recent bull run could be ending appeared towards the end of 2021 when inflation began to rise quite sharply, initially triggered by supply chain issues as the world came out of the tightest stages of lockdown.

Our earlier blog post suggested other reasons for the rise in inflation, and since this was published we have seen the CPI continue to climb higher, now being 4.6%. The situation is similar elsewhere in the world, with inflation in the US and Eurozone at 6.8% and 4.9%, respectively.

To stave off rapidly rising inflation; global central banks are poised to hike interest rates this year, the Bank of England already having done so in December last year with an increase from 0.1% to 0.25%; the first increase in three years.

It is reasonable to expect that this might cause businesses and consumers to behave differently, which is likely to have a knock-on effect on share prices.

As interest rates rise, borrowing becomes more expensive for both businesses and consumers.

For businesses, this has a negative impact on profit margins and in turn makes shares in those same businesses less attractive.

At the same time, consumer demand is likely to decrease because individuals have less money to spend if their mortgage and other debt repayments increase. Over time, that tends to pull downwards on demand, which in turn brings inflation back under control.

By how much, and how quickly, interest rates are increased is a delicate balancing act for central banks though. Being too slow to react could cause inflation to spiral out of control, but being too eager could cause severe hardship for businesses and consumers.

In addition to already implemented and anticipated interest rate increases, governments are also bringing to a close the various support measures that have been in place for almost the last two years, with many furlough schemes having now ended and a tapering of fiscal stimulus already underway.

This means that an already fragile global economy will be forced to stand unaided, and 2022 may therefore be the year that determines whether financial markets really have come out of the pandemic as strongly as they seem to have done so up to now.

In view of the challenges that lie ahead, it would be easy to conclude that there is less opportunity for investments to perform well over the next 12 months.

However, if the last two years have taught us anything, it is that it is impossible to second-guess investment markets. Following the sharp falls in markets in March 2020, no-one would have predicted the speed and strength of the immediate recovery, nor would many have predicted that 2021 would have delivered such significant returns.

Whether 2022 is good, bad or indifferent for investments remains to be seen, and we will only know this with the benefit of hindsight.

Investing with a horizon of 12 months though is not ‘investing’, it is more akin to ‘speculating’.

A speculator will generally target short-term gains (and, by definition, would therefore need to be accepting of a higher level of risk of loss in the short-term) and will try to enter and exit the markets at precisely the right moments. Getting this timing right may result in large profits, but getting it wrong, similarly large losses.

Personal injury claimants will often be investing for the very long-term and, as such, can take a more measured approach and can be much less concerned about how markets perform in any given 12-month period.

Whilst discrete annual performance should of course be monitored, assessed and benchmarked, what is of far greater importance is how an investment portfolio performs over the longer-term and ultimately that this is sufficient to meet a claimant’s future needs.

The foundation of our financial planning process is ensuring that all such future needs can be met throughout a claimant’s lifetime, and we remain of the view that being invested, and being able to remain invested, through good times and bad, is key to achieving these long-term financial goals.

We look forward to 2022 with hope that a clearer path out of the pandemic is found, optimism that the global economy will maintain its recovery, and conviction that investment opportunities will continue to present themselves.

Most importantly, we hope that all our clients and colleagues remain safe and well throughout 2022 and wish you a Happy New Year.