Sell everything?

Feb 13th, 2017It is now just over 12 months since economists at Royal Bank of Scotland issued the stark warning to “sell everything” and brace for a “cataclysmic year”.

They predicted that, during 2016, major stock markets could fall by a fifth, and oil could plummet to $16 a barrel.

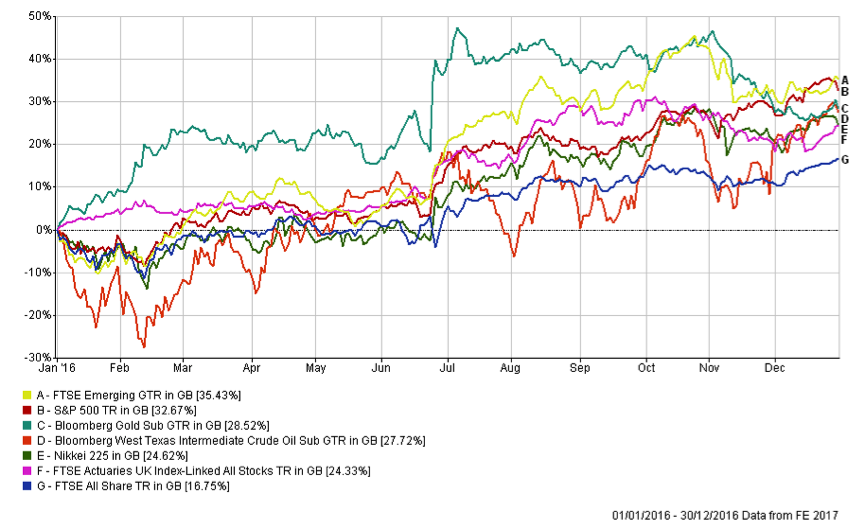

Any investors who followed the advice to sell up will surely be cursing the team at RBS today, as the dire predictions did not play out quite as thought. In fact, 2016 turned out to be a year in which it was difficult NOT to make positive investment returns, as the following chart illustrates:

As can clearly be seen, the returns on major asset classes did not come about because of a lack of volatility; rather they did because of its presence.

On a number of occasions during 2016, the media reported how billions had been "wiped off" the value of the stock market, although seldom did we hear about those days when billions were "wiped back on". In fact, some of the greatest returns throughout 2016 were achieved in the immediate aftermath of billions having been wiped off the stockmarket, a prime example of this being the fallout from Brexit.

On the morning of the result of the EU referendum, the FTSE 100 initially fell by over 8%, with the FTSE 250 recording falls well into double figures. Such enormous falls were not limited to the UK either, with similar patterns seen across markets the world over.

However, rather than being the start of something wholly dire for investors, this actually marked the beginning of an almost uninterrupted period of growth for most asset classes. Indeed, the FTSE 100 since went on to reach record highs, in spite of other events (e.g. Trump’s victory in the US elections) that had the capacity to derail the market’s relentless onward march.

It is fair to say that markets did not behave as most expected, particularly in light of the calendar of events throughout last year, and they without question did not conform to the foretellings of the team of analysts and economists at RBS.

2016 is a year that ought to reiterate some key principles of investment:

- Trying to predict how broad markets and individual asset classes will perform over any given period of time is nigh on impossible, and attempting to second guess how they will react to individual events even more so.

- Although we are seeing much greater correlation in how assets perform, diversification of investment into asset classes is one of the best ‘insurance policies’ that an investor can buy.

- Markets rise and markets fall; this is an inherent feature of investing. Volatility itself is not risk, it is actually a key source of return and whilst attempts should be made to control it, it should be embraced rather than avoided.

- Investing for the long term means that the focus should be on just that, with less significance placed on events in the short term.