A billion here, a billion there, and pretty soon you’re talking real money…

Jun 16th, 2021Forty years ago, when I started work after graduating, I drew out £30 a week from the bank to spend on life’s essentials. That was a little over half my gross salary at the time, so more than half of my net income. Now, and almost certainly like you, I use next to no cash at all.

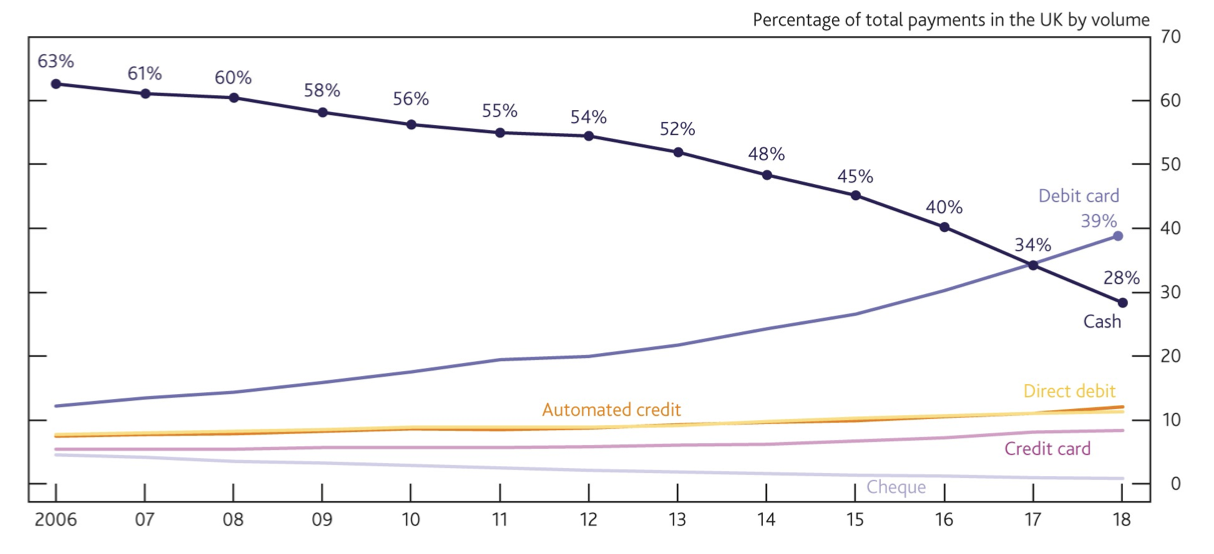

In fact, as the chart below (from the Bank of England) shows, the proportion of total payments in the UK made in cash has fallen dramatically over the last decade:

This raises an important question for the Bank of England, which was considered in a discussion paper published on 12th March 2020:

As the issuer of the safest and most trusted form of money in the economy, should the Bank provide the public with electronic money – or a Central Bank Digital Currency (CBDC) – as a complement to physical banknotes?

On 19th April 2021, the Bank of England and HM Treasury announced the joint creation of a Central Bank Digital Currency Taskforce to coordinate the exploration of a potential UK CBDC. According to the Bank, a CBDC would be a new form of digital money issued by the Bank of England and for use by households and businesses. It would exist alongside cash and bank deposits, rather than replacing them.

A CBDC would allow households and businesses to directly make electronic payments using money issued by the Bank of England, rather than via a commercial bank (such as through an app or online banking), or debit/credit cards. The CBDC would be denominated in Sterling, in the same way as banknotes, i.e. assuming the same role as cash in providing a safe and trusted form of money.

This is fundamentally different to a privately issued cryptocurrency, such as Bitcoin. The Bank of England’s Financial Policy Committee considered such currencies do not currently pose a risk to monetary or financial stability in the UK. However, the Committee concluded that such ‘assets’ do pose a risk to investors, and anyone buying cryptocurrency should be prepared to lose all their money.

So, ‘real money’ might become something that is no longer tangible. This does of course raise concerns over privacy, since a transaction in a CBDC will leave a digital ‘footprint’ in a way that a banknote will not, particularly given the close ties between the state and the issuer. Whilst the Bank of England has not yet given any firm commitment to proceed, it has taken another step along the road towards the creation of a digital currency.