Introduction of Land Transaction Tax in Wales

Apr 13th, 2018In Wales, with effect from April 2018, Land Transaction Tax (LTT) will replace Stamp Duty Land Tax (SDLT).

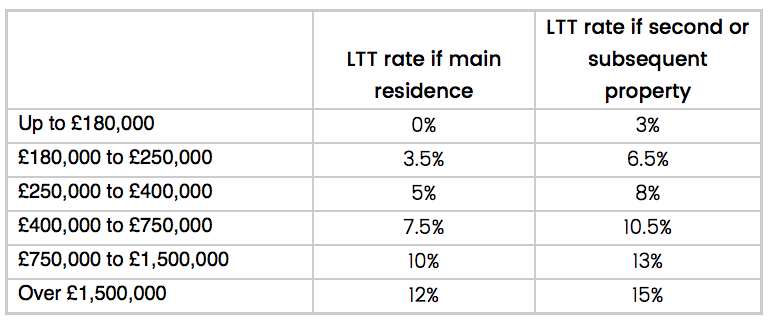

Whilst the underlying legislation and rules surrounding the application of the tax will remain more or less in line with those concerning SDLT, it is the tax bands and the rates of tax payable that will be subject to most change.

Like SDLT, the rate of LTT payable depends on the price of the property, and what proportion of this falls into each band.

If one or more residential properties are already owned, a high rate of LTT is payable; this rate effectively being 3% on top of the standard rate.

The relevant bands and tax rates are summarised below:

By way of example, an individual purchasing their first home for £300,000 would pay 0% on the first £180,000, 3.5% on the next £70,000 and 5% on the next £50,000, resulting in total LTT of £4,950 (this compares with a stamp duty bill of £5,000 under the SDLT methodology).

Under the LTT regime, buyers of lower value properties will pay less tax, with LTT only becoming more ‘expensive’ on properties valued at £400,000 or more.

LTT came into force on 1st April 2018 and any property purchased on or after this date within the Welsh borders will be subject to this, rather than SDLT.