The rise and rise of Inheritance Tax

Jun 4th, 2019As Benjamin Franklin once said: “The only things certain in life are death and taxes”, and Inheritance Tax (IHT) touches on both. In simple terms, IHT is the tax paid on assets (after IHT allowances are deducted) left when someone dies and the current rate payable is 40%.

During the 2015/16 tax year, 4.2% of deaths in the UK were liable to IHT, increasing by 0.3% from 2014/15. This reflects a longer-term trend since 2008/09, with this partly attributable to the Nil Rate Band being frozen at £325,000 since April 2009 until at least 2021. IHT receipts totalled some £5.2 billion in 2017/18, which represents an increase of 8%, or £388 million, compared to 2016/17.

Furthermore, the total number of estates liable to IHT has increased every year since 2009/10; alongside this, the net capital value of estates has increased by £17 billion to £79 billion. A significant factor in this continual increase in tax receipts can also be attributed to the increase in the value of the residential property, with 54% of the above increase attributed to this asset alone.

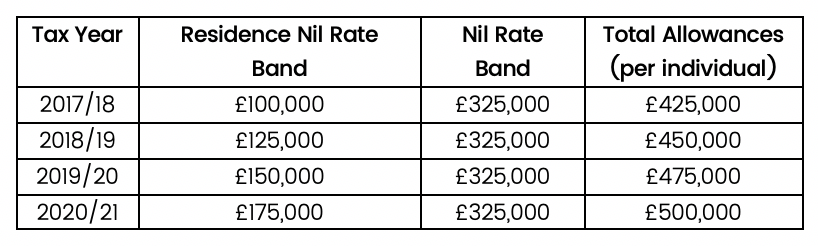

Introduced in 2017/18, the ‘Main Residence’ allowance or Residence Nil Rate Band was a means for the Government to allow couples to pass a home to the beneficiaries worth up to £1 million (£500,000 for single individuals) without an IHT liability, with this allowance being gradually introduced, reaching the £1 million level (for couples) in 2020/21:

As demonstrated above, this allowance is available to homeowners in addition to the standard Nil Rate Band, providing certain conditions are met.These conditions can be complicated in practice; however, some of the key considerations are as follows:

- The Residence Nil Rate Band is only available where the recipient of the property is a direct descendant, such as children, grandchildren, step-children, adopted children or a child fostered at any time by the individual.

- The use of Trusts associated with the property should be carefully considered, with appropriate advice sought, as depending on the type of Trust arrangement this could restrict the availability of the Residence Nil Rate Band to the estate.

- The value of the Residence Nil Rate Band is limited to the value of the property inherited:

- For example, if an individual dies in the 2019/20 tax year leaving property worth £100,000 and other assets of £400,000 to their child, the maximum available Residence Nil Rate Bond would be capped at £100,000. Therefore, the total allowances available to the estate would be £425,000, meaning IHT would be payable on the remaining £75,000.

- As with the standard Nil Rate Band, any unused Residence Nil Rate Band can be transferred to the estate of a surviving spouse for use upon their death.

- Where an estate exceeds £2 million, the Residence Nil Rate Band reduces by £1 for every £2 over the £2 million threshold.

In conclusion, the availability of additional allowances which can be utilised to reduce potential tax liabilities are likely to be viewed as a positive. However, as with many such allowances, the complexities associated with their implementation need to be fully considered and understood in order to maximise the potential benefit.

From a financial planning perspective, this highlights the need for regular consideration to be given to the construction of your Will and your estate-planning arrangements, even if you believe your circumstances may not have changed.