Court of Protection approves gift of £6,000,000 to be made by an attorney, to himself, from his mother’s assets.

Oct 10th, 2018In a recent judgment (PBC v JMA & Ors [2018] EWCOP 19), Her Honour Judge Hilder, Senior Judge at the Court of Protection, approved an application made by the attorney of a 72 year old lady, to make a gift of £6m to himself, from his mother’s c.£19m estate, in order to mitigate the impact of IHT upon his mother’s eventual death.

The rationale behind the request was that the estate will eventually fall liable for a significant IHT liability upon the death of JMA, and therefore making the gift of £6m will serve to reduce this liability, as the gift will fall entirely outside of the estate after seven years (with only a tapering liability applying after 3 years).

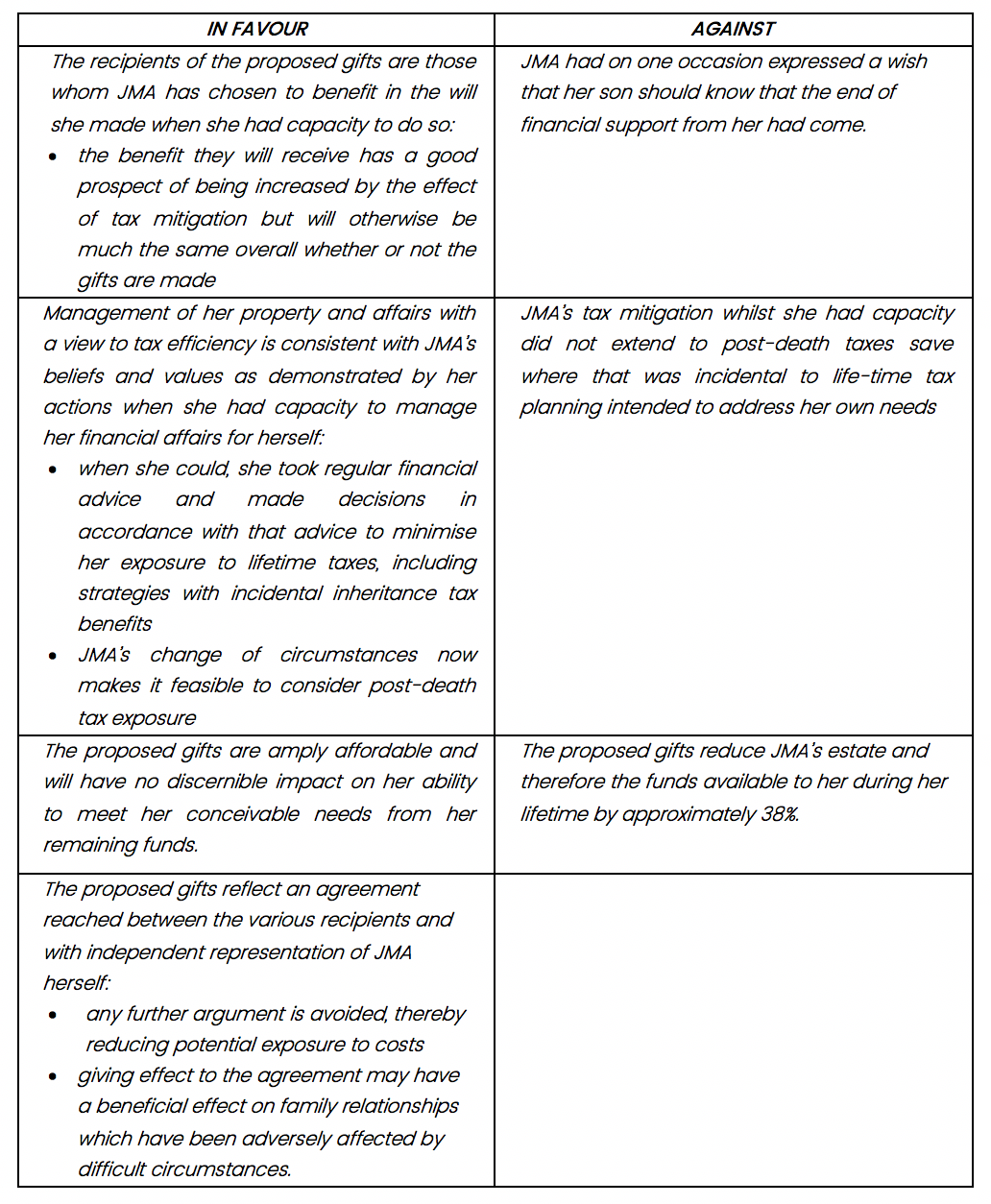

The application, which also included making a series of other gifts totalling a further £1m to various charities, was approved, with HH Judge Hilder offering the following balancing exercise in the summary of her judgment:

Though the value of the gifts in this particular instance are unusually significant, many of the underlying factors are consistent with those present for many attorneys and deputies in similar situations.There is often a desire to provide financially for P’s family in a cost effective and tax-efficient manner, but this must not be detrimental to the provision of P’s future needs.

Furthermore, the amount must be broadly similar in value to the gifts given by P historically, prior to losing capacity, and above all be proportionate to their overall assets at the time that the gift is made.

In short, making any gift should be in the best interests of P, and not the recipient of the gift.

Whilst an interesting judgment, approval for similar tax planning measures for incapacitated recipients of personal injury damages is unlikely to be easy to obtain.

Receiving even a significant award of compensation in respect of personal injury is not a ‘windfall’, as the award will be required to meet P’s important, and perhaps substantial, needs over the course of their lifetime.

As a result, it is difficult to see how the Court could agree that significant gifts for tax planning purposes would be in P’s best interests, unless exceptional circumstances applied.