Don't let the tax tail wag the investment dog

Jun 30th, 2021"Don't let the tax tail wag the investment dog" is a saying that almost anyone involved within the financial advice sector will be aware of. In essence, when considering suitable advice, any tax liabilities should be seen as a ‘result’ of the advice and not the main driver. A nice saying, but how realistic is it?

It is true that most IFAs would like to provide advice without having to give too much thought to tax. However, this is rarely the case, as ensuring that an individual’s portfolio remains as tax efficient as possible is key in respect of long-term planning. Whilst there are a number of taxes that are payable, there is one specific tax which careful consideration is given to when providing investment advice: Capital Gains Tax.

What is Capital Gains Tax (CGT)?

It is probably easiest to start by simply turning it around. CGT is a tax payable on the gains realised from capital. It is payable on most personal possessions worth £6,000 or more (the main exception being motor vehicles), properties that are not an individual’s main residence, and most notably from our perspective, on unit-linked collective investments.

Each tax year, all individuals receive an annual tax-free CGT allowance. During the current tax year (2021/22), the tax-free allowance for all individuals is £12,300; for Trusts that are not bare in nature, this amount is halved to £6,150.

Gains in excess of this allowance are currently taxed at the standard rate of 10% or the higher rate of 20%, depending on the amount of the total capital gains and the amount of income received during the tax year.

A ‘gain’ is the difference in value between the amount the asset was purchased for, known as the base cost, and the current value of the asset. Where an asset is 'disposed of' for less than it was originally purchased, this is called a ‘loss’.

CGT only becomes payable once an asset has been 'disposed of'. This being the case, it is important that an individual’s portfolio is often reviewed as, if not properly managed, CGT can become an issue in years to come.

Managing CGT – Utilising the annual tax-free allowance

The first, and ideal, way to manage CGT is by making regular use of the annual tax-free allowance.

In a perfect scenario, an individual would make use of their annual allowance each year and, by doing so, would reduce the total level of gain within the portfolio to sustainable levels. By way of example, the below outlines how utilising the annual tax-free allowance can be of great benefit.

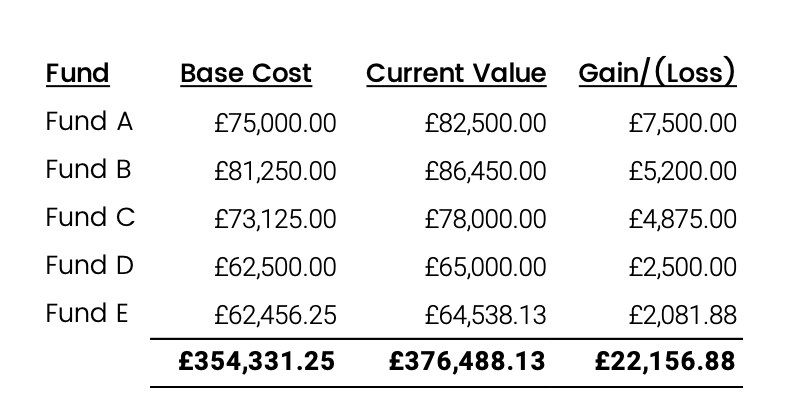

Example portfolio (1) – Utilising the CGT allowance

As can be seen from the above, the total gains held within the portfolio total £22,156.88. If no action was taken, it is likely that this figure would increase over time, assuming markets continue to grow, and therefore, should there ever be a need to withdraw either a proportion or the entirety of the portfolio, CGT would become payable.

However, upon reviewing the portfolio, it may be considered suitable for capital to be ‘switched’ from existing funds into new funds. A switch is simply a process in which the capital is sold from one fund with the proceeds then used to immediately purchase units within an alternative fund. The alternative fund can either be a new addition to the portfolio or an existing fund holding.

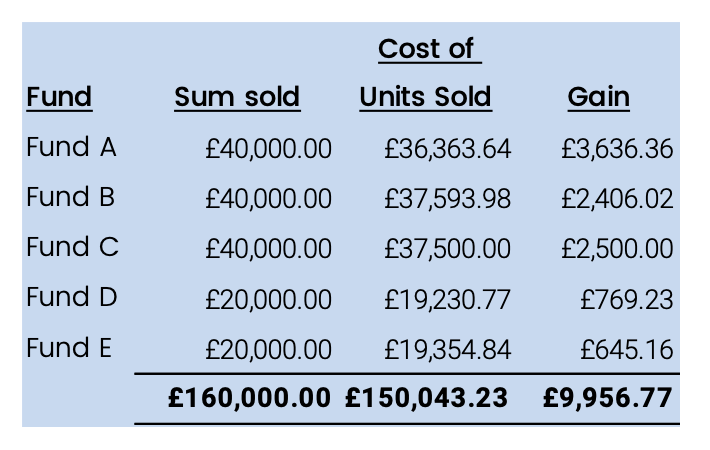

For instance, the table below shows an example of the gains that would be realised by switching funds, within the CGT allowance:

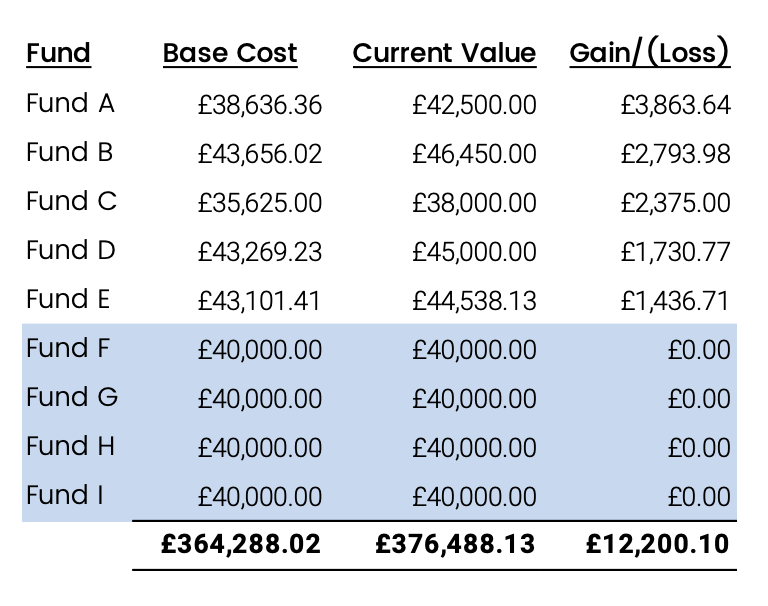

The above table shows that a total sum of £160,000 has been sold and gains of £9,956.77 have been realised.The ‘sum sold’ of £160,000 can then be redistributed to alternative funds, and in this instance, that is a number of new funds, as follows:

By completing these switches, the following has been achieved:

- Diversification within the portfolio has been increased meaning that the portfolio now has exposure to a larger number of funds and alternative fund manager views;

- A significant number of gains have been ‘crystallised’.Whilst the level of gains within the portfolio is now lower than previously, the total value remains unchanged.Therefore, a proportion of the gains has essentially been banked; and

- Total gains within the portfolio have now reduced to such a degree that all funds could be withdrawn once the next annual tax-free allowance becomes available, though this is dependent on any change in value, or allowance, in the interim.

If this process was undertaken each year, with consideration given to which fund to switch money into and away from, it is possible that the latent gains within the portfolio will continue to stay at manageable levels.

Managing CGT – Accepting a CGT liability

Whilst, in the above instance, utilising the annual tax-free allowance was sufficient to manage CGT, this is not ordinarily the case for portfolios that are larger in value and/or have been held for a considerable length of time.

In these instances, there can be a benefit in accepting gains outside of the CGT allowance and paying any tax liability, as outlined in the following example:

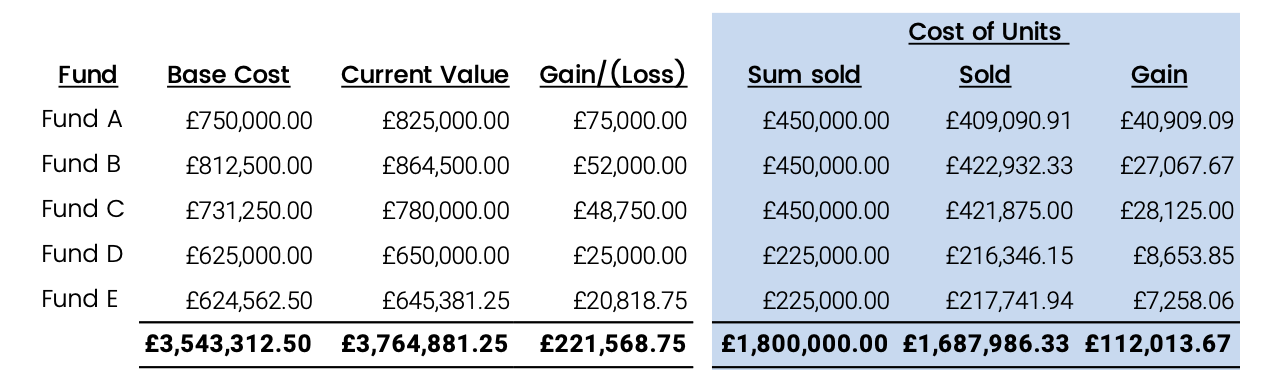

Example portfolio (2) – Crystallising significant gains

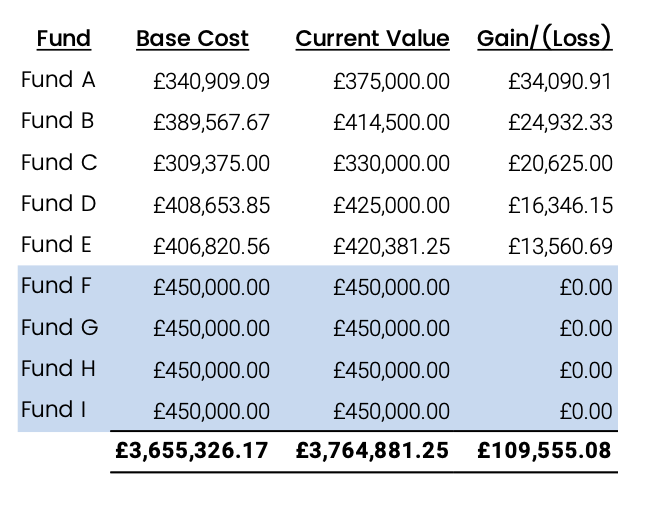

As detailed above, gains within the portfolio total £221,568.75.We have recommended that the sum of £1,800,000 be switched out and redistributed to new funds and in doing so, gains of £112,013.67 will be realised.

Following redistribution of the switch proceeds, the portfolio is now made up of the following:

As per the previous example, diversification within the portfolio has increased whilst significant gains have been crystallised.However, the drawback in this instance is that a CGT liability will now be due.

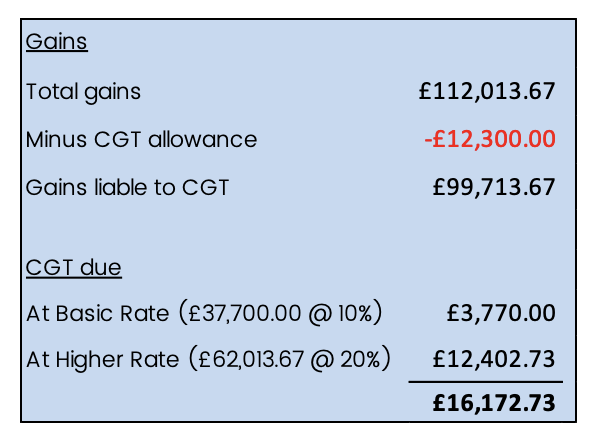

In line with the gains realised, CGT would be payable as follows:

On the face of it, realising a payable tax bill of £16,172.73 might not appear to be the best outcome.

However, we deem this to be an acceptable outcome for the following reasons:

- A significant proportion of gains within the portfolio have been realised which will result in greater tax efficiency in future years;

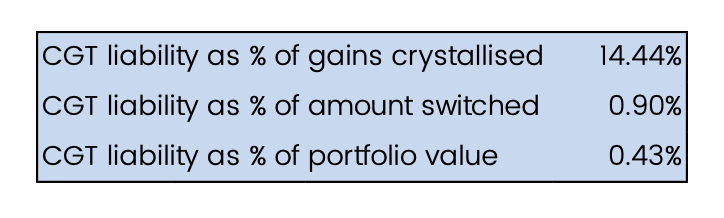

- When putting the tax liability into context and viewing this alongside the portfolio, it can be seen that the overall liability is only a small percentage of the funds held:

- By realising gains and paying CGT now, we have taken advantage of the existing CGT rates which are considered to be ‘cheap’.

In respect of that third point, I can hear the cries of ‘CHEAP?!’ as I write this. Whilst a tax bill of £16,172.73 is not cheap per se, it is cheap when compared to other tax rates.

As already mentioned, CGT rates are 10% for basic rate and 20% for higher rate.If you consider these against the current income tax rates, of 20% for basic rate and 40% for higher rate, then it starts to become clearer why CGT is referred to as being ‘cheap’. By way of example, in the event that CGT rates were brought in line with income tax rates, a payable liability of £32,345.46 would be due for completing the same exercise outlined above.

Comparing the current CGT rates to Income Tax rates is not too far-fetched as it may initially sound.

The future of CGT

On 14th July 2020, the Chancellor wrote to the Office of Tax Simplification (OTS) requesting a review of the taxation of chargeable gains in respect of individuals and small businesses.Following this, the OTS issued their first report in this respect in November 2020 and a copy of their report can be viewed here.

The very first, and arguably most notable, recommendation within the report states:

If the government considers the simplification priority is to reduce distortions to behaviour, it should either:

-Consider more closely aligning Capital Gains Tax rates with Income Tax rates; or

-Consider addressing boundary issues as between Capital Gains Tax and Income Tax.

Whilst other recommendations are outlined within the OTS report, it is evident that making changes to the existing tax regime is something that is being considered by the Government and it would not be surprising to see CGT rates brought in line with Income Tax rates in the not-too-distant future.This being the case, taking advantage of the current ‘cheap’ CGT rates makes considerable sense.

Returning to the original question, “Do not allow the tax tail to wag the investment dog”; is this realistic?

Clearly, tax cannot be the main driver in all aspects of advice, and often it is something that simply has to be accepted.

However, for the reasons outlined, maybe sometimes it’s not so bad to allow ‘the tax tail to wag the investment dog’ as in reality, with likely changes to the Capital Gains Tax regime, ensuring a portfolio is as tax efficient as possible has to be considered to be in an individual’s best interests.