Welsh Rates of Income Tax

Jul 1st, 2019From April 2019, the level of income tax paid by Welsh taxpayers will, to a degree, be determined by the Welsh Government.Rates may therefore vary from those paid by tax payers in England and Northern Ireland.

Whilst responsibility for collecting the tax will remain with the HM Revenues and Custom (HMRC), the UK Government will reduce each of the three rates of income tax – basic, higher and additional rates – paid by Welsh taxpayers by 10p. The final rate of income tax for Welsh taxpayers will be determined by the Welsh Government, and will be a combination of the reduced English rates and the new Welsh rates.

The final rates each year could be more, or less than those paid by tax payers in England and Northern Ireland; the Scottish Parliament already decides the income tax rates for Scottish taxpayers. However, the Welsh Government website has previously stated that in order to maintain the money for public services in Wales, the Welsh Government would need to re-apply the 10p removed by the UK government to each of the tax bands.

During the 2019/20 tax year the National Assembly for Wales has agreed that the Welsh rates of income tax will be equivalent to those charged in England.

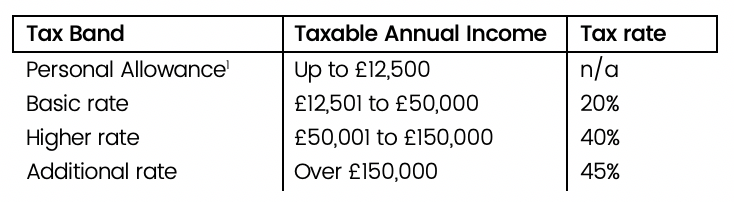

It should also be noted that the personal allowance (the amount you can earn before you start to pay income tax), will remain the same as the rest of the UK. As will the point at which the higher and additional rates income tax apply.

For completeness, the tax bands for 2019 are as follows:

Any changes in Welsh Income Tax will only affect Welsh Tax Payers, i.e. those who live in Wales, regardless of where they work. If you happen to live in Wales for part of the year and also live in another part of the UK for some of the year, the tax you will pay will depend on where you spend the majority of your time.

More information can be found at the following link

https://gov.wales/docs/caecd/publications/181212-income-tax-faqs-en.pdf