The impact of war

Mar 4th, 2022Russia’s invasion of Ukraine, which began on 24th February 2022, has quickly escalated to become a deeply concerning and saddening issue.

First and foremost, on a humanitarian level, lives have been lost and an entire population is now living in fear of what is yet to come. The UN refugee agency has warned that the invasion could result in the largest refugee crisis of this century, with 1 million people already having fled the country, and this figure possibly rising to 4 million in coming weeks and months.

Heavy fighting continues in Ukraine as this blog is being written, with the Russian army maintaining a targeted bombing campaign of Kyiv and Kharkiv, as well as other cities and districts.

Russia’s moves have, quite rightly, brought widespread condemnation from almost all global governments, with heavy sanctions having been put in place almost as soon as the invasion began.

So far, military intervention by any other country has not happened, with support for Ukraine limited to the supply of arms, medical equipment, food aid and other supplies.

We all continue to watch as events unfold, hopeful that things do not deteriorate further and that a diplomatic resolution can be found, ending the suffering and fear for the Ukrainian people.

We will, of course, not lose sight of the humanitarian aspect of these events, and with sensitivity to the realities that those in Ukraine are facing, an update on how investment markets have reacted is provided below.

Global stock markets, as they so often do, have reacted to developments almost instantly.

Initially, as Russian troops entered Ukraine, markets fell sharply.

On 24th February, the FTSE 100 (the index commonly used by UK news outlets) closed down 3.8%. European markets were also down over 4% and the Dow Jones was down around 1.5%. Given what had happened, this was unsurprising, as markets do not like uncertainty and had effectively braced themselves for the worst.

However, the very next day, after Western governments had been swift to react with punishing sanctions intended to destabilise the Russian economy (Russia’s Central Bank was forced to more than double its interest rate to 20% overnight), markets bounced back, recovering almost all losses from the previous day.

Since then, as the situation has continued to unfold, with either positive or negative news flow, markets have reacted accordingly, which has led to heightened volatility.

Markets have though, so far, not seen significant sustained falls.

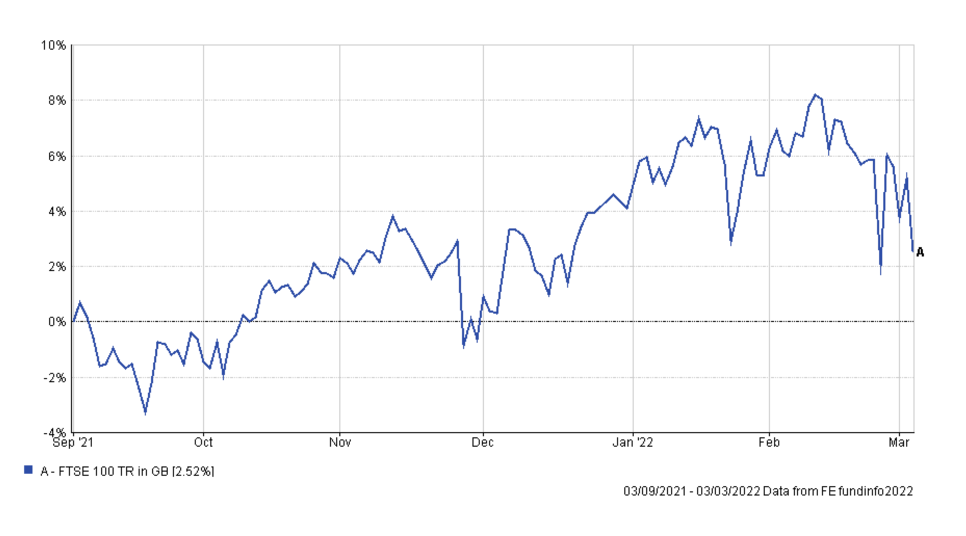

The following chart shows how the FTSE 100 has fared over the last six months, from which it can be seen that whilst there has been a little more volatility day-to-day in the past week, it has held up reasonably well, given the circumstances:

Although only a short timeframe, it is somewhat reassuring to see that markets have been resilient in the face of these events.

Whilst the uncertainty about what might happen next has seen some assets fall a little in value, others have risen; examples being typical ‘safe havens’ such as gold and bonds.

Oil and gas prices have also risen, given Russia’s dominance as producers of these commodities. Crude oil, now trading at $110 per barrel, is at its highest level since 2014.

The uncertainty has also accelerated some existing trends in investment markets, one of which being a shift from ‘growth’ stocks (investments that typically have higher growth potential but yield little in the way of dividends) to ‘value’ stocks (investments that have less capital growth potential but pay consistent, stable dividends). Since the start of the year, value stocks have, in the main, outperformed growth stocks, and this appears to have been the case to an even greater extent since the Russian invasion began.

All of this underlines the importance of holding a diversified portfolio of investments, encompassing many asset classes, sectors, regions, and investment styles.

Most important of all though is to remember that investment is a long-term journey, and how it is vital to avoid making rash decisions as a ‘knee-jerk’ reaction during uncertain times.

All of our clients will hold an appropriate level of cash reserve to ensure that even if markets do dip in coming months, and even years, they will not be forced to take money out of investments whilst values are lower and can wait for markets to recover.

Whether the conflict in Ukraine lasts further weeks, months or longer, holding a suitably diverse and risk-controlled portfolio, will continue to offer the best opportunity to achieve a real (i.e. above inflation) return on capital over the long-term.

There will undoubtably be more news to emerge from Ukraine daily, and we only hope that any developments are positive, for the sake of those involved in this tragedy.

For now, we continue to monitor the situation closely, and will advise clients in the event of there being any reason to take any action is respect of their portfolios.