Inflation - Where to next?

Nov 16th, 2021It will not have escaped attention that inflation in the UK, and indeed globally, is on the rise.

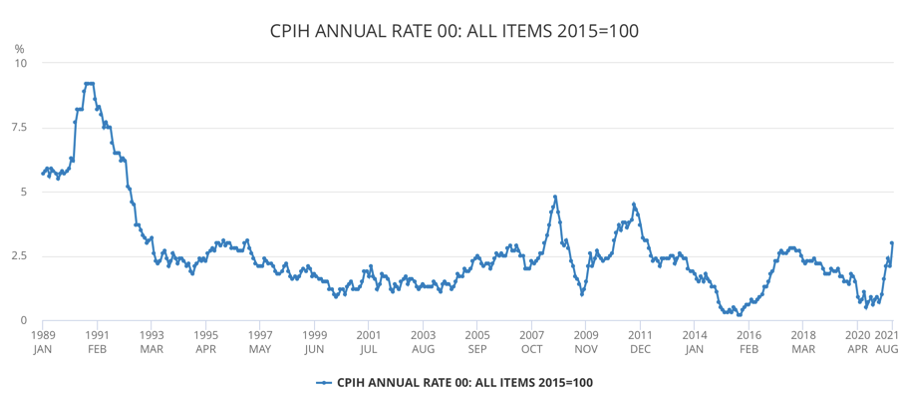

The UK has experienced average inflation of roughly 2% per annum (as measured by the Consumer Prices Index, or CPI) over the last three decades.

Following a sustained period of consistent, very low inflation since 1993, there was some volatility between 2007 and 2011, with the CPI twice spiking to around 5% in the aftermath of the global financial crisis before falling back to within a range of near zero and around 3%. In the main though, inflation has largely been kept under control.

Today, the prospects for Inflation are arguably more uncertain than they have been for many years, not only in terms of how long higher inflation will persist for, but also how high it will climb.

The last time CPI inflation was above 5% was in the early 1990’s, when it peaked at just under 10%, as illustrated by the following chart (source: ONS):

We would need to go back almost 50 years, to 1973, to see inflation of over 10%, when the RPI (the then standard measure) peaked at over 20%.

The stability of inflation throughout the last 30 years or so has persisted despite periods of significant economic turbulence, during which we have experienced several large-scale events, including the 1997 Asian financial crisis, the bursting of the dot-com bubble, the global financial crisis and a two-decade long war in the Middle East.

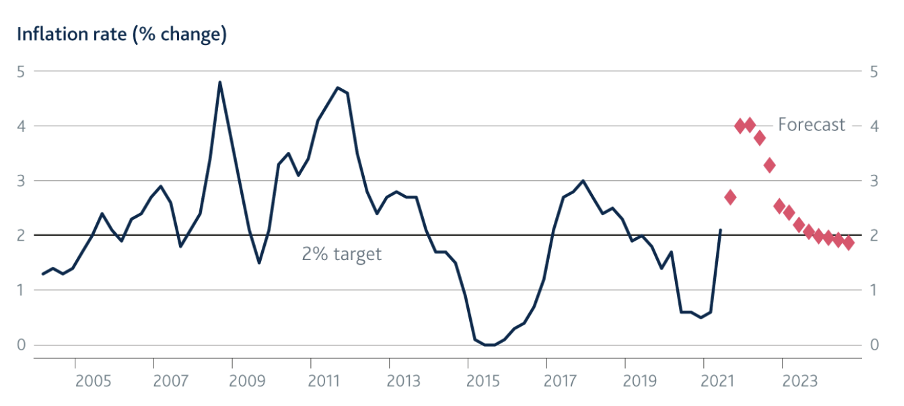

Indeed, even now, despite the Covid-19 pandemic, a truly global economic event that has, as yet unknown, unprecedented financial consequences, the Bank of England appears to have confidence that higher inflation is only transitory, and it can be brought back to its target of 2%, reasonably quickly.

In its August 2021 report, the Bank of England’s Monetary Policy Committee (MPC)set out expectations for inflation over the next two years, as shown below:

However, since the publication of this report, inflation has become an ever-increasing concern for most, with the BoE’s new Chief Economist, Huw Pill, himself stating this month (source: FT.com):

“In my view, the balance of risks is currently shifting towards great concerns about the inflation outlook, as the current strength of inflation looks set to prove more long-lasting than originally anticipated”

There are several factors that may, to a greater or lesser extent, be contributing towards the surge in inflation, some of which were largely predictable and some that were not, which might explain why the MPC has needed to heavily revise (upwards) its forecasts for inflation several times this year.

The main cited reason is the Covid 19 pandemic, which has dominated the economic environment for the last 18 months, in terms of its impact initially through lockdown, and then through the steady route towards ‘normality’.

The pandemic caused a combination of economic ‘supply’ and ‘demand’ shocks, which pull prices for goods and services in opposite directions; generally speaking:

- decreased supply results in prices going up;

- increased demand results in prices going up;

- increased supply results in falling prices; and

- decreased demand results in falling prices.

Throughout the pandemic, and as we have started to emerge from it, we have experienced all possible permutations of supply and demand, in almost every industry or sector.

As a result, much of the uncertainty in respect of inflation stems from the difficulty in knowing how the relationship between supply and demand will develop over coming months and years.

That said, there does now seem to be an almost universally accepted view that higher inflation is here to stay for the short-term at least.

It is worth noting that inflation in the UK over the last few months is starting from a very low level, even in the context of the last 30 years which has seen fairly benign levels, as set out previously. The CPI started to fall below the 30-year average of 2% towards the end of 2019 and spent much of 2020 at less than 1%.

There is an argument to say that the surge in inflation over recent months is simply a ‘reversion to mean’, and that the MPC will be successful in using the tools it has available to stem a prolonged overshoot of its 2% target.

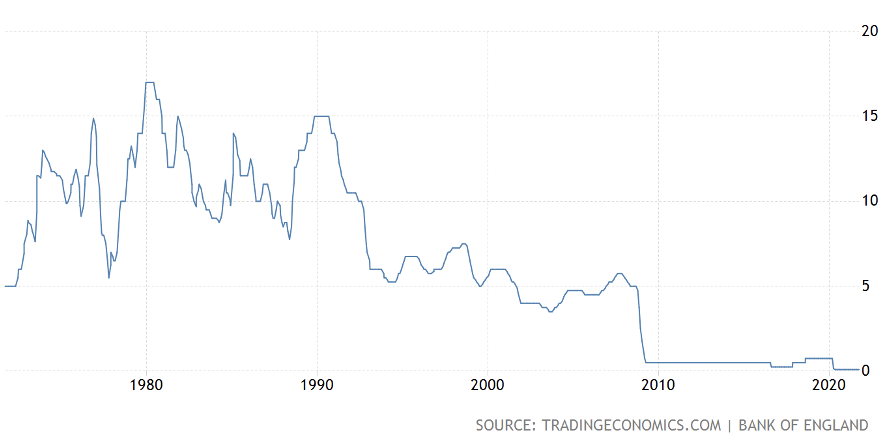

The MPC’s main tool is the setting of the Bank of England base rate.

In simple terms, an increase in the base rate results in a rise in borrowing costs (i.e. mortgages), meaning that households have less disposable income, which in turn ought to reduce demand for goods and services, thereby putting downward pressure on prices.A reduction in the base rate would have the opposite effect.

The Bank of England base rate currently sits at 0.1%, where it has been for much of the period since 2008, as the following shows:

With rates having been so low, for so long, it may only take a modest uptick in interest rates for the MPC to successfully temper inflation, with there clearly being scope for more aggressive action to be taken if necessary.

A recent article in the Financial Times highlighted that markets are anticipating rate increases to come sooner rather than later:

“Markets currently expect a 15 basis point [0.15 per cent] rate rise by February, with an increasing likelihood of the first increase at the December meeting. Traders are betting on interest rates rising from the current level of 0.1 per cent to 0.75 per cent by the end of 2022.”

The impact of even a modest increase in the base rate should not be underestimated.

Whilst it will be mildly beneficial for savers who have struggled to earn a real return on their deposits for many years, it could prove to be ‘tipping point’ for mortgage holders who may already be financially stretched.

Higher interest rates will also increase borrowing costs for companies who have fought to survive throughout the pandemic, which may stifle growth or even threaten their survival.

It is therefore clear that the MPC has a difficult task in striking the right balance; move too slowly in raising rates and risk inflation running out of control, but move too quickly and risk seriously damaging the finances of a great many individuals or derailing an already fragile economic recovery.

For personal injury investors, whose award of damages represent their lifetimes wealth, the prospect of rising inflation coupled with a precarious economic outlook may be worrying. This does emphasise the need to take expert financial advice, ensuring that the award is invested in the most appropriate manner and able to provide for all future needs.