NHS Litigation: Reform or Revolution? Part 1 – financial background

Jan 20th, 2022In any walk of life, it is inescapable that adverse outcomes will happen, sometimes of a catastrophic nature. In some walks of life, systems have been devised to minimise the risk of such failures, such as the construction of high-rise buildings and the aircraft industry.

And yet, in NHS hospitals, despite many reports and recommendations, avoidable outcomes continue to occur, notably the number of cases involving injuries to children at or around the time of their birth.

The only remedy available to the injured patient is to sue the hospital. This is a cumbersome, slow and expensive process, with an outcome that can only deliver a crude form of compensation – money.

The House of Commons Select Committee on Health and Social Care is considering alternatives to litigation in response to adverse patient outcomes in hospital settings.

In the first session on 16th November 2021, Chair Jeremy Hunt MP provided data on the cost of clinical negligence claims to the NHS. The cost of claims in the previous year was put at £10 billion, with total provision for potential liabilities at £82.8 billion. Mr Hunt said that the provision was increasing at the rate of £6 billion a year.

It was against this backdrop that the committee was seeking to find (cheaper) alternatives.

Given the detailed nature of the subject, I have split this blog in two parts. This first part deals with the financials and ends with the questions posed by the committee. Part two deals with the evidence given during the first session by two eminent and experienced lawyers; Sir Robert Francis QC and Sir Ian Kennedy.

First the numbers. The annual report and accounts published by NHS Resolution provides detailed figures for the year ended 31st March 2021 and is the source of the financial information included in this article.

The estimated cost of incidents arising from clinical activity in the year 2020/21 was £7.9 billion – this is not the amount paid out in the year (see later), rather it is an estimate of how much will be paid out in the future, relating to the year 2020/21.

The provision for total potential liabilities arising from such incidents notified up to 31st March 2021 is £82.8 billion – the figure mentioned by Mr Hunt. This amount will never have to be paid out in one year. A significant and rising proportion of damages settlements and awards take the form of periodical payments (PPOs), which are paid out over the lifetime of an individual, and can therefore stretch many decades into the future.

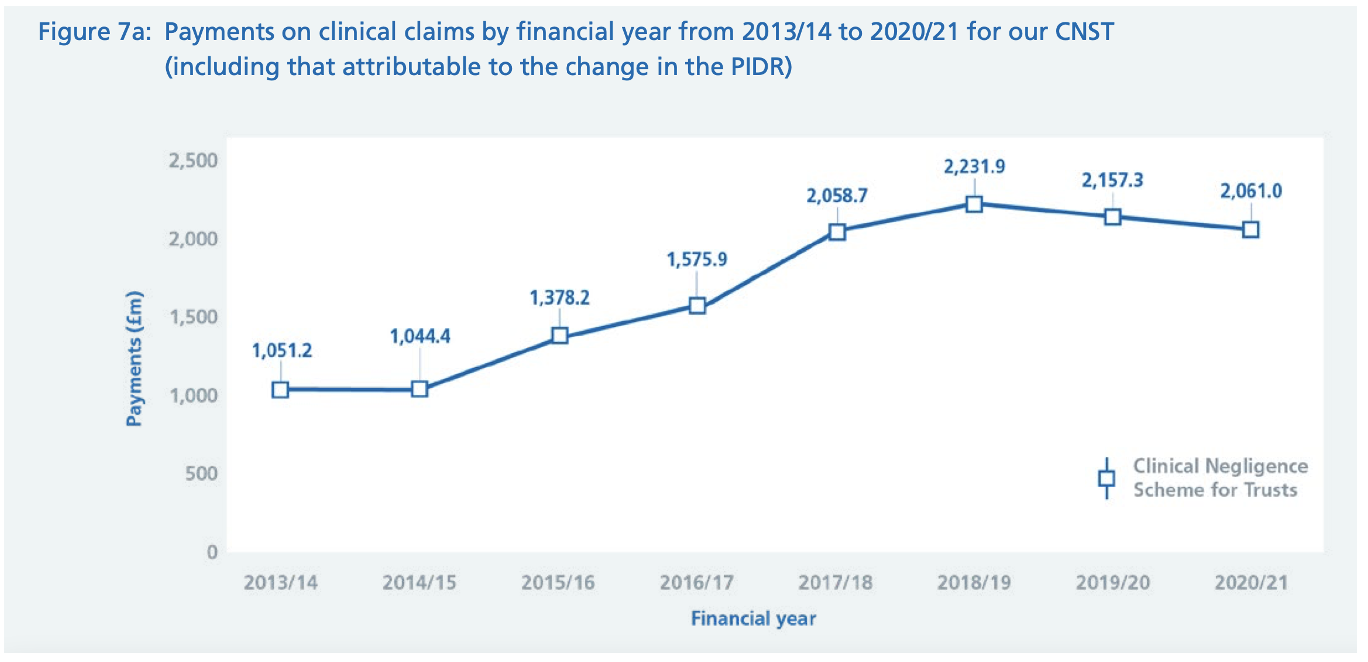

Figure 7a shows a decline in annual payments from a peak in 2018/19:

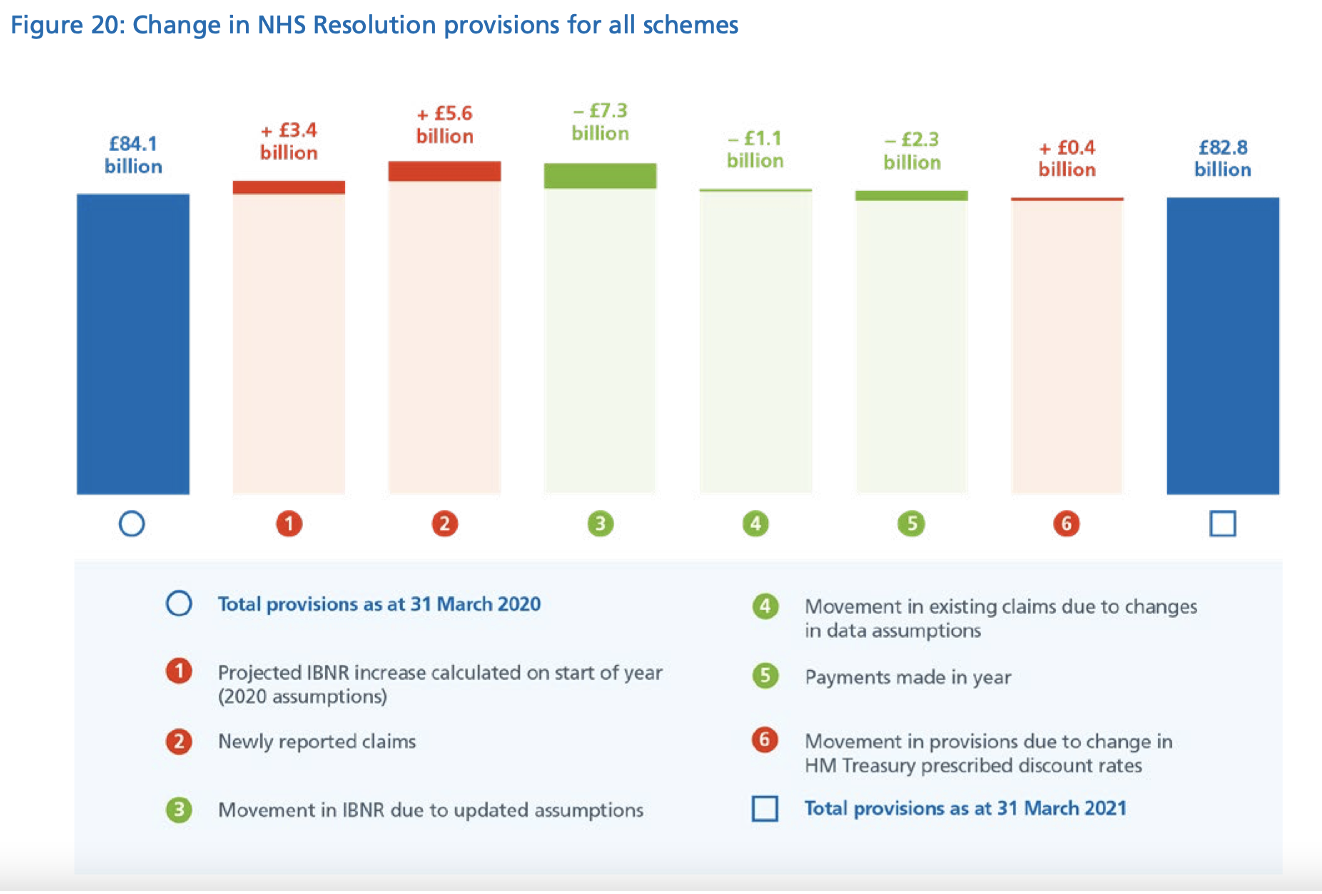

Figure 20 reveals an overall decrease in the provision for total liabilities:

As can be seen, there are several moving parts in these provisions. Crucially, these provisions are estimates, based on assumptions. For example, column 3 in Figure 20 shows a reduction of £7.3 billion in the previous estimate of IBNR (crudely, the pipeline of expected claims), largely arising from:

- A decrease of £2.8 billion for inflation and average cost of claim assumptions, reflecting the lower than expected growth PPOs which make up the majority of the IBNR provision;

- A decrease of £1.9 billion for the future earnings growth (ASHE) assumption which affects the (capital) value of PPOs. This indicates a lowering of expectations about future earnings growth; and

- A decrease of £3.5 billion for the projected number of claims, following reductions in the actual number reported.

Column 5 of Figure 20 reports the actual value of payments made in the year (£2.3 billion), and the accounts reveal that this figure includes a growing number of PPOs: up from 1,712 in payment at 31st March 2016 to 2,445 at 31st March 2021.

There is no escaping the fact that these are all very large numbers, and it is understandable that alternatives to the existing regime should be considered.

Mr Hunt framed the discussion in terms of the following:

- Should there be easier access to compensation, e.g. following the Swedish model of establishing avoidability rather than negligence?

- Should the amount of compensation be based on NHS top-up costs (rather than the full costs of private provision of care)?

In Part 2, I will deal specifically with the evidence of Sir Ian Kennedy, which advocates the radical step of dispensing with the lawyers, and Sir Robert Francis, which addresses systemic failings of the NHS.